Major brand owners like Absolut, Diageo, Carlsberg, and PepsiCo are developing paper bottles, but what does a market analyst say about this paper chase?

Until the last couple years the concept of a paper bottle would seem at best an oxymoron, but innovations continue to break barriers in the pursuit of packaging that offers sustainability benefits, ideally aligned with recycling.

Thus, there’s renewed interest by major brands in paper bottles, which though not new, are experiencing increased activity, undoubtedly sparked by the anti-plastic sentiment sweeping the globe.

Until the last couple years the concept of a paper bottle would seem at best an oxymoron, but innovations continue to break barriers in the pursuit of packaging that offers sustainability benefits, ideally aligned with recycling.

Thus, there’s renewed interest by major brands in paper bottles, which though not new, are experiencing increased activity, undoubtedly sparked by the anti-plastic sentiment sweeping the globe.https://e9684372136265cda297c5523bc40606.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

A historical sampling of Packaging Digest features uncovered a mix of the new and old among these paper bottle citations across various markets from spirits to beer to detergent starting in 2015 and extending through last month; the links appear at the end of this report.

In light of the news that Diageo, the parent company of the Johnnie Walker brand, will package the spirits brand in 100% plastic-free bottles starting in 2021 (see Paper Bottle Coming Soon to a Liquor Store Near You, published August 2020), Lux Research released this commentary: “Diageo has formed a [joint venture] called Pulpex with Pilot Lite to develop the paper bottle technology and will manufacture the paper bottles in-house. The company has always used third-party suppliers for its glass bottles, so it is unclear why the company decided to produce the paper bottles internally; it is very unusual for a brand owner company to vertically integrate itself to produce packaging along with its core products. Clients should note that it is better to partner with startups or converters to obtain sustainable packaging solutions rather than trying to do it all themselves.”

The writer is market analyst and Lux Research Associate Drishti Masand, who responds to our questions about paper bottles in this exclusive interview.

Until the last couple years the concept of a paper bottle would seem at best an oxymoron, but innovations continue to break barriers in the pursuit of packaging that offers sustainability benefits, ideally aligned with recycling.

Thus, there’s renewed interest by major brands in paper bottles, which though not new, are experiencing increased activity, undoubtedly sparked by the anti-plastic sentiment sweeping the globe.https://e9684372136265cda297c5523bc40606.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

A historical sampling of Packaging Digest features uncovered a mix of the new and old among these paper bottle citations across various markets from spirits to beer to detergent starting in 2015 and extending through last month; the links appear at the end of this report.

In light of the news that Diageo, the parent company of the Johnnie Walker brand, will package the spirits brand in 100% plastic-free bottles starting in 2021 (see Paper Bottle Coming Soon to a Liquor Store Near You, published August 2020), Lux Research released this commentary: “Diageo has formed a [joint venture] called Pulpex with Pilot Lite to develop the paper bottle technology and will manufacture the paper bottles in-house. The company has always used third-party suppliers for its glass bottles, so it is unclear why the company decided to produce the paper bottles internally; it is very unusual for a brand owner company to vertically integrate itself to produce packaging along with its core products. Clients should note that it is better to partner with startups or converters to obtain sustainable packaging solutions rather than trying to do it all themselves.”

The writer is market analyst and Lux Research Associate Drishti Masand, who responds to our questions about paper bottles in this exclusive interview.

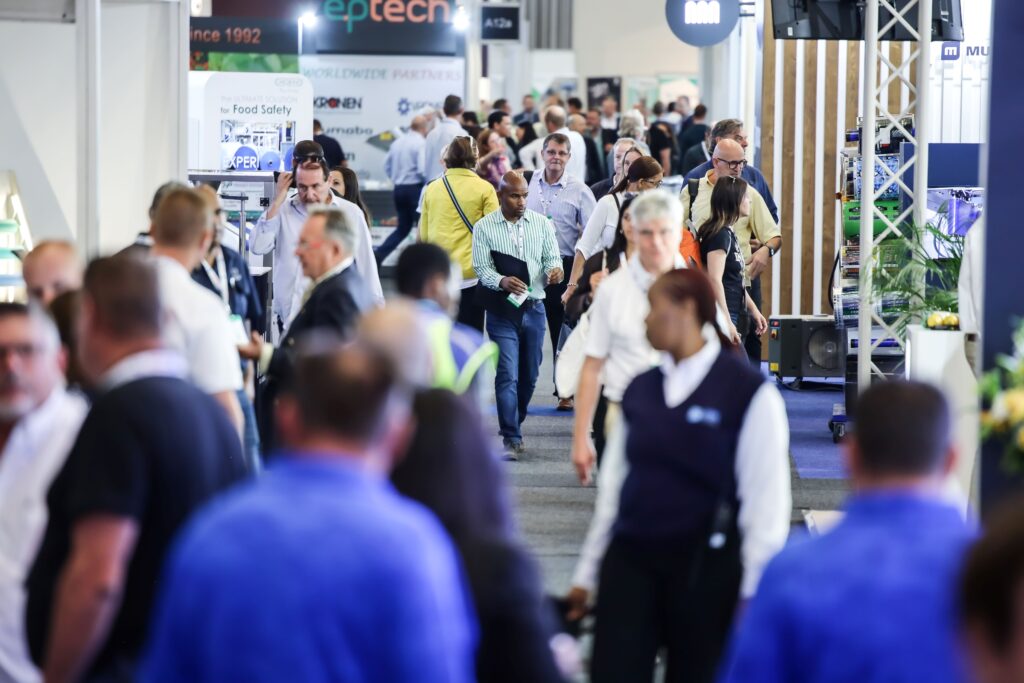

Carlsberg Brewing |

| A year ago, Carlsberg unveiled two new research prototypes of the Green Fibre Bottle, both made from sustainably sourced wood fibres, fully recyclable, and with an inner barrier to allow the bottles to contain beer. One prototype uses a thin recycled PET polymer film barrier, and the other a 100% bio-based PEF polymer film barrier. |

What’s behind the recent announcements about paper bottles in beverage markets?

Masand: The paper bottle for beverage markets is not a new innovation; it has been under development for a few years with other brands like The Coca-Cola Company, Carlsberg and a start-up company called Paboco. Carlsberg was the first company and launched calls for a pulp-based bottle in 2016 to replace its glass bottles. It has sought different partners to realize this goal. While the concept of a paper bottle is not new, it can be considered as an emerging trend as the popularity and awareness of it is on the rise at the moment with more brand and industries, for example personal care brands like L’Oreal, also adopting paper bottles.

What are the differences in the paper bottles from Diageo, PepsiCo, and Frugalpac?

Masand: Diageo founded Pulpex, in partnership with Pilot Lite (a venture management company). The announcements for Diageo’s paper bottles for Johnnie Walker, and PepsiCo’s are the same technology and application: to replace glass/plastic bottles with paper bottles for drinks. Frugal Bottle is also a very similar technology and is targeting the same application as Pulpex.

Loss of transparency is a major downside in a move away from plastic packaging. What are other shortcomings?

Masand: Paper is frequently suggested as a substitute for plastic packaging, even more so than bioplastics. Several companies are shifting to paper-based packaging to reduce the use of plastics.

However, current available data suggests that paper packaging generally requires several times more mass to fulfil the same function as its plastic counterpart. As a result, the overall environmental impact tends to be higher for paper, except in its carbon footprint. Additionally, replacing plastic with paper could lead to a serious supply problem. Paper is a short-term solution and will simply shift the burden for packaging problems.

Are paper bottles at a cost premium to plastic?

Masand: All paper products for packaging typically have a 10-20 cents per piece premium. This is a big challenge that hinders paper packaging adoption. To overcome the issue, the industry has been moving to adopt a wider feedstock by using agricultural waste fibres along with hardwood and softwood fibres. The hope is that by using waste fibres, companies can achieve more sustainability and reduce costs to then lower the price premium for products.

What other beverage markets may be vulnerable to a plastic-to-paper bottle change?

Masand: The bottled water is another beverage market facing potential penetration from alternate materials like paper bottles. However, aluminium bottles and cans seem to be dominating as an alternative to plastic rather than paper.Some start-ups include Open Water, Reign Water Company, Wallaby Water, and CanO Water

Should plastic bottle suppliers be nervous?

Masand: No, it is highly unlikely for paper bottles to disruptive plastic bottles on a significant scale, at least in the near-term. In the long run, I think recycling technologies will improve considerably, allowing for a higher recycling rate for plastic bottles and other plastic packaging to enable a circular economy for plastics. With that, it is unlikely for any alternate materials to disrupt the plastic industry.

What are the technical challenges to the paper bottle?

Masand: Paper bottles need a coating or plastic liner on the inside to provide moisture barrier, and resistance to other environmental factors. While companies claim the layers can be easily separated for recyclability, we are sceptical of those claims given the challenges in recycling plastic-lined paper today and the likelihood that the companies aren’t using any technology to allow for that separation.

Also, the cap and closure for these paper bottles is aluminium- or plastic-based, so it would need to be separated and sent into different recycling streams — that is highly dependent on efficient collection and sorting, and so again makes us sceptical of the end-of-life processing success rate

Until the last couple years the concept of a paper bottle would seem at best an oxymoron, but innovations continue to break barriers in the pursuit of packaging that offers sustainability benefits, ideally aligned with recycling.

Thus, there’s renewed interest by major brands in paper bottles, which though not new, are experiencing increased activity, undoubtedly sparked by the anti-plastic sentiment sweeping the globe.https://e9684372136265cda297c5523bc40606.safeframe.googlesyndication.com/safeframe/1-0-37/html/container.html

A historical sampling of Packaging Digest features uncovered a mix of the new and old among these paper bottle citations across various markets from spirits to beer to detergent starting in 2015 and extending through last month; the links appear at the end of this report.

In light of the news that Diageo, the parent company of the Johnnie Walker brand, will package the spirits brand in 100% plastic-free bottles starting in 2021 (see Paper Bottle Coming Soon to a Liquor Store Near You, published August 2020), Lux Research released this commentary: “Diageo has formed a [joint venture] called Pulpex with Pilot Lite to develop the paper bottle technology and will manufacture the paper bottles in-house. The company has always used third-party suppliers for its glass bottles, so it is unclear why the company decided to produce the paper bottles internally; it is very unusual for a brand owner company to vertically integrate itself to produce packaging along with its core products. Clients should note that it is better to partner with startups or converters to obtain sustainable packaging solutions rather than trying to do it all themselves.”

The writer is market analyst and Lux Research Associate Drishti Masand, who responds to our questions about paper bottles in this exclusive interview.

Carlsberg Brewing |

| A year ago, Carlsberg unveiled two new research prototypes of the Green Fibre Bottle, both made from sustainably sourced wood fibres, fully recyclable, and with an inner barrier to allow the bottles to contain beer. One prototype uses a thin recycled PET polymer film barrier, and the other a 100% bio-based PEF polymer film barrier. |

What’s behind the recent announcements about paper bottles in beverage markets?

Masand: The paper bottle for beverage markets is not a new innovation; it has been under development for a few years with other brands like The Coca-Cola Company, Carlsberg and a start-up company called Paboco. Carlsberg was the first company and launched calls for a pulp-based bottle in 2016 to replace its glass bottles. It has sought different partners to realize this goal. While the concept of a paper bottle is not new, it can be considered as an emerging trend as the popularity and awareness of it is on the rise at the moment with more brand and industries, for example personal care brands like L’Oreal, also adopting paper bottles.

Packaging Digest |

| A line-up of paper bottles not to scale from left-to-right: Diageo Johnnie Walker, Frugal Bottles for wines, and Absolut vodka. |

What are the differences in the paper bottles from Diageo, PepsiCo, and Frugalpac?

Masand: Diageo founded Pulpex, in partnership with Pilot Lite (a venture management company). The announcements for Diageo’s paper bottles for Johnnie Walker, and PepsiCo’s are the same technology and application: to replace glass/plastic bottles with paper bottles for drinks. Frugal Bottle is also a very similar technology and is targeting the same application as Pulpex.

Loss of transparency is a major downside in a move away from plastic packaging. What are other shortcomings?

Masand: Paper is frequently suggested as a substitute for plastic packaging, even more so than bioplastics. Several companies are shifting to paper-based packaging to reduce the use of plastics.

However, current available data suggests that paper packaging generally requires several times more mass to fulfil the same function as its plastic counterpart. As a result, the overall environmental impact tends to be higher for paper, except in its carbon footprint. Additionally, replacing plastic with paper could lead to a serious supply problem. Paper is a short-term solution and will simply shift the burden for packaging problems.

|

| The 750mL Frugal Bottle made by Frugalpac is made from 94% recycled paperboard with a food-grade liner and, at just 83 grams, is up to five times lighter than a glass bottle. An independent Life Cycle Analysis by Intertek found it has a carbon footprint up to six times (84%) lower than a glass bottle and more than a third less than a bottle made from 100% rPET. |

Are paper bottles at a cost premium to plastic?

Masand: All paper products for packaging typically have a 10-20 cents per piece premium. This is a big challenge that hinders paper packaging adoption. To overcome the issue, the industry has been moving to adopt a wider feedstock by using agricultural waste fibres along with hardwood and softwood fibres. The hope is that by using waste fibres, companies can achieve more sustainability and reduce costs to then lower the price premium for products.

What other beverage markets may be vulnerable to a plastic-to-paper bottle change?

Masand: The bottled water is another beverage market facing potential penetration from alternate materials like paper bottles. However, aluminium bottles and cans seem to be dominating as an alternative to plastic rather than paper.Some start-ups include Open Water, Reign Water Company, Wallaby Water, and CanO Water.

Should plastic bottle suppliers be nervous?

Masand: No, it is highly unlikely for paper bottles to disruptive plastic bottles on a significant scale, at least in the near-term. In the long run, I think recycling technologies will improve considerably, allowing for a higher recycling rate for plastic bottles and other plastic packaging to enable a circular economy for plastics. With that, it is unlikely for any alternate materials to disrupt the plastic industry.

What are the technical challenges to the paper bottle?

Masand: Paper bottles need a coating or plastic liner on the inside to provide moisture barrier, and resistance to other environmental factors. While companies claim the layers can be easily separated for recyclability, we are sceptical of those claims given the challenges in recycling plastic-lined paper today and the likelihood that the companies aren’t using any technology to allow for that separation.

Also, the cap and closure for these paper bottles is aluminium- or plastic-based, so it would need to be separated and sent into different recycling streams — that is highly dependent on efficient collection and sorting, and so again makes us sceptical of the end-of-life processing success rate.

Final thoughts?

Masand: Many companies are adopting solutions that solve the issue of plastics waste; however, they create a new set of sustainability challenges. All the alternative materials solutions have a separate set of problems associated with them; thus, they simply shift the packaging problem. With that, paper packaging will continue to grow for adoption, but will never be a substantial threat to plastics.

https://www.packagingdigest.com/beverage-packaging/are-paper-bottles-sustainable-and-practical